How Long Do You Depreciate A Barn . Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). However, now you can use five years instead of seven for most. Web regular depreciation still claim an expense over 3 to 20 years based on class life.

from ninasoap.com

Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. Web regular depreciation still claim an expense over 3 to 20 years based on class life. However, now you can use five years instead of seven for most. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c).

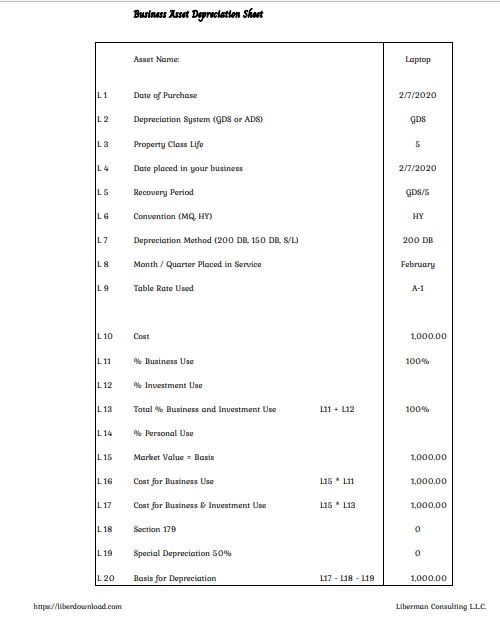

Depreciation Worksheet PDF Nina's Soap

How Long Do You Depreciate A Barn Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web regular depreciation still claim an expense over 3 to 20 years based on class life. However, now you can use five years instead of seven for most. Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c).

From www.youtube.com

How Long can you Depreciate a Rental Property? YouTube How Long Do You Depreciate A Barn Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web 2021 irs publication 225 provides depreciation. How Long Do You Depreciate A Barn.

From www.outdooroo.com

Do Steel Homes Barndominiums Depreciate? How To Calculate Outdoor How Long Do You Depreciate A Barn Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web regular depreciation still claim an expense over 3 to 20 years based on class life.. How Long Do You Depreciate A Barn.

From exowmrhbn.blob.core.windows.net

How Long To Depreciate Flooring at Lottie Rogers blog How Long Do You Depreciate A Barn Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. However, now you can use five years instead of seven for most. Web barn owners will. How Long Do You Depreciate A Barn.

From dxoodkvon.blob.core.windows.net

How Do You Depreciate Furniture at Duane Mahar blog How Long Do You Depreciate A Barn Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c).. How Long Do You Depreciate A Barn.

From boaterpal.com

How Much Do Boats Depreciate? (Helpful Chart) Boater Pal How Long Do You Depreciate A Barn Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). However, now you can use five years instead of seven for most. Web regular depreciation. How Long Do You Depreciate A Barn.

From quickbooks.intuit.com

What is depreciation and how is it calculated? QuickBooks How Long Do You Depreciate A Barn Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. However, now you can use five years instead of seven for most. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). Web barn owners will. How Long Do You Depreciate A Barn.

From homesecurityline.com

How Many Years Do You Depreciate A Security System? How Long Do You Depreciate A Barn Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. However, now you can use five years instead of seven for most. Web barn owners will usually depreciate. How Long Do You Depreciate A Barn.

From www.youtube.com

Can You Depreciate A NNN Property? YouTube How Long Do You Depreciate A Barn However, now you can use five years instead of seven for most. Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. Web 2021 irs publication 225. How Long Do You Depreciate A Barn.

From fabalabse.com

How is depreciation recorded? Leia aqui How do you record depreciation How Long Do You Depreciate A Barn Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. However, now you can use five years instead of seven for most. Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were. How Long Do You Depreciate A Barn.

From mameymalynda.pages.dev

Section 179 Bonus Depreciation 2024 Calculator Babb Mariam How Long Do You Depreciate A Barn However, now you can use five years instead of seven for most. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web barn owners will usually depreciate the cost of their barns over 20 years,. How Long Do You Depreciate A Barn.

From exowmrhbn.blob.core.windows.net

How Long To Depreciate Flooring at Lottie Rogers blog How Long Do You Depreciate A Barn However, now you can use five years instead of seven for most. Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web barn owners will usually depreciate. How Long Do You Depreciate A Barn.

From engineeringsadvice.com

How Long Do You Depreciate An Air Conditioner In A Rental Engineering How Long Do You Depreciate A Barn Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. However, now you can use five years instead of seven for most. Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web 2021 irs publication 225. How Long Do You Depreciate A Barn.

From slideplayer.com

REVENUE and EXPENDITURE BUDGETED & NONBUDGETED FUNDS ppt download How Long Do You Depreciate A Barn Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take. How Long Do You Depreciate A Barn.

From burbankpainters.com

How Long to Depreciate Exterior Painting? Discover the Lifespan of Your How Long Do You Depreciate A Barn Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. However, now you can use five years instead of seven for most. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). Web generally, if. How Long Do You Depreciate A Barn.

From engineeringsadvice.com

How Long Do You Depreciate An Air Conditioner In A Rental Engineering How Long Do You Depreciate A Barn However, now you can use five years instead of seven for most. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. Web regular depreciation. How Long Do You Depreciate A Barn.

From www.youtube.com

"How many years do you depreciate a business car?" Excerpt from How Long Do You Depreciate A Barn However, now you can use five years instead of seven for most. Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web barn owners will usually depreciate. How Long Do You Depreciate A Barn.

From exocbnyxt.blob.core.windows.net

How Long Can You Depreciate Business Equipment at Dayna Franco blog How Long Do You Depreciate A Barn Web generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the. Web 2021 irs publication 225 provides depreciation periods for farm assets, separated between gds and ads (irs 2021c). However, now you can use five years instead of seven for most. Web barn owners will. How Long Do You Depreciate A Barn.

From www.copyright-protect.net

Let the experts talk about How long do you depreciate a trademark How Long Do You Depreciate A Barn Web regular depreciation still claim an expense over 3 to 20 years based on class life. Web barn owners will usually depreciate the cost of their barns over 20 years, allowing them to take a deduction for 5 percent of their cost basis. However, now you can use five years instead of seven for most. Web generally, if you hold. How Long Do You Depreciate A Barn.